can i write off cryptocurrency losses

SAM and certain of its officers. SAM securities between April 22 2021.

Cryptocurrencies Price Prediction Bitcoin Litecoin Ripple Asian Wrap 10 Dec Best Crypto Bitcoin Price Weekly Forecast

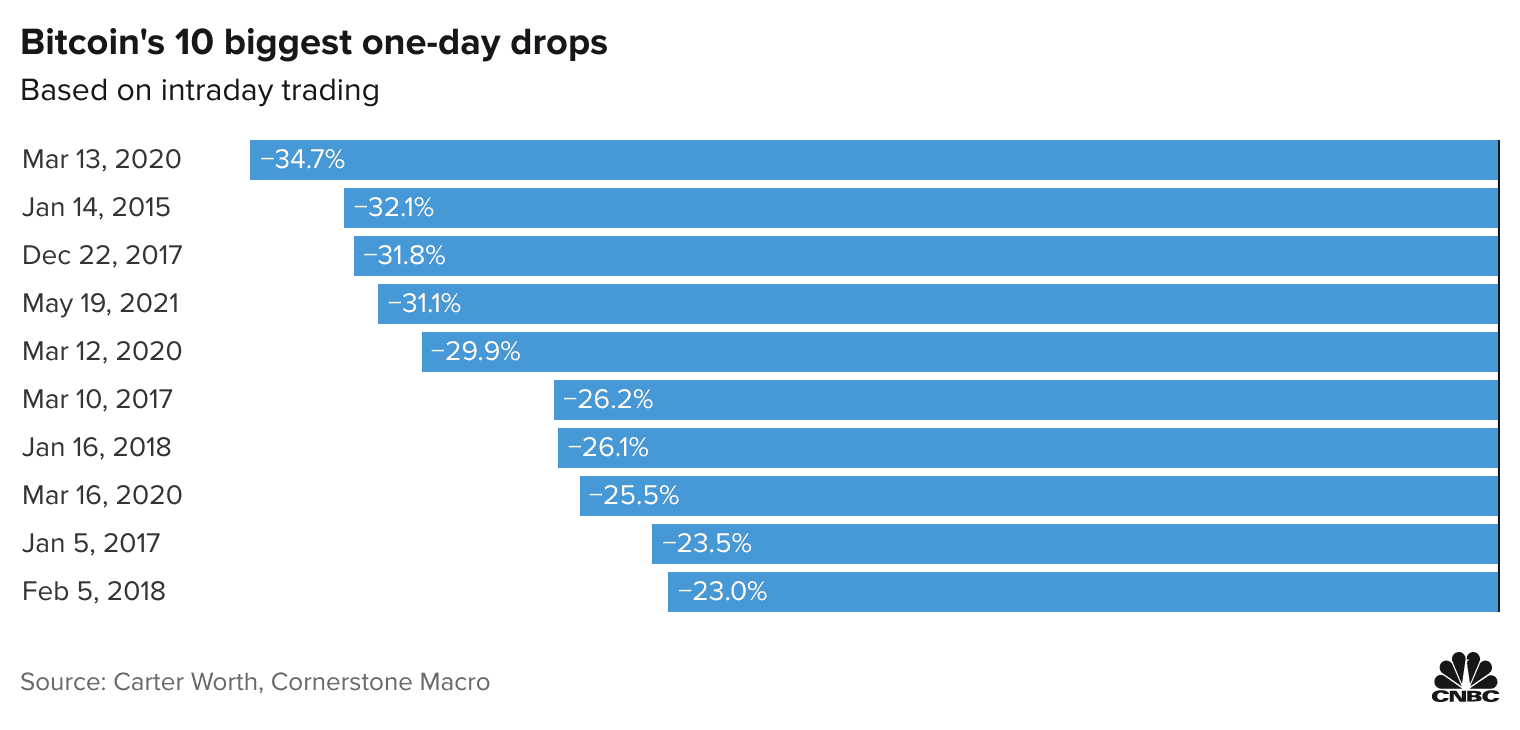

During the recent crash in January 2018 hobby-investors got burned.

. Pomerantz LLP announces that a class action lawsuit has been filed against The Boston Beer Company Inc. If your losses exceed your gains you can write off up to 3000 of the excess losses each year against your income. The class action.

Zillow plans to close its iBuying. 02 2021 GLOBE NEWSWIRE -- Robbins Geller Rudman Dowd LLP announces that purchasers or acquirers of The Boston Beer Company Inc. Zillows shares have tumbled by about 37 since Friday.

If you can land a contract with a business customer you can earn a higher-end rate than working with homeowners in most cases. Only invest what you can lose. For example if you have 5000 in winnings but 8000 in losses your deduction is limited to 5000.

Thus suppose you lose 53000 on. Boston Beer or the Company NYSE. GunBot is a well known cryptocurrency trading bot which uses individual strategies that are completely customisable to fit your trading style.

Q3 earnings show a 304 million write-down for Zillows iBuying business with more losses to come. Bittrex Binance Poloniex Bitfinex Cexio GDAX Kraken and Cryptopia. For example if you have a 20000 loss and a 16000 gain you can.

It can operate on the following exchanges. The amount of gambling losses you can deduct can never exceed the winnings you report as income. Reports of frustration and losses came at the cost of broken monitors smashed laptops and heavy monetary lossesWhile the rules are in more particular order of importance its safe to assume that this is the most important rule the rule to rule the rules.

Invest in a few vans and some marketing and hire a few low-skilled but reliable workers and you can be off and running with a. You could not write off the remaining 3000 or carry it forward to future years. You can reduce any amount of taxable capital gains as long as you have gross losses to offset them.

Sure Air India has losses but its long list of assets is impressive too The buyer will get Air India express a 50 percent stake in AISATS the second largest air fleet in the country lucrative. SAN DIEGO Oct.

A Canadian Tax Guide For Cryptocurrencies

.png)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

5 Aspiring Benefits Of Cryptocurrency Trading Bots Cryptocurrency Trading Trading Automated Trading

Us Stock Market Chalks Up Huge Weekly Losses But Bitcoin Dxy Impress Us Stock Market Investing Cryptocurrency

Is Bitcoin Exchange Halal Bitcoin Price Bitcoin Bitcoin Transaction

Cryptocurrency Gifts Donations Tax Guide Taxbit Blog

How Is Cryptocurrency Taxed Forbes Advisor

How To Invest In Speculative Investments Like Bitcoin And Cryptocurrency Without Losing Your Shirt Speculat Investing Investing For Retirement Investing Money

How To Report Taxes On Cryptocurrency Mining Coinpanda

Bitcoin Taxes How Is Cryptocurrency Taxed In 2021 Picnic S Blog

Bitcoin Crash Opens Door To A Tax Loophole For Investors

Bitcoin Crash Opens Door To A Tax Loophole For Investors

.png)

Reporting Stolen Or Lost Cryptocurrency For Tax Purposes Cryptotrader Tax

The Year The Dot Com Bubble Burst Infographic Bubbles Social Media Infographic

Cryptocurrency Taxes In Canada The 2021 Guide Koinly

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

Sudden Cyworld Shutdown Puts Clink Crypto Investors At Risk Report Https Ift Tt 2mdeyip Cryptocurrency Bitcoin Blockchain

Epingle Sur Blockblog Fr Le Meilleur De L Actualite Bitcoin Blockchain Crypto Francophone International