claiming cryptocurrency losses on taxes

The available fraction limits the annual rate at which transferred losses may be claimed by the head company. The term tax deduction refers to any expense that can be used to reduce your taxable income.

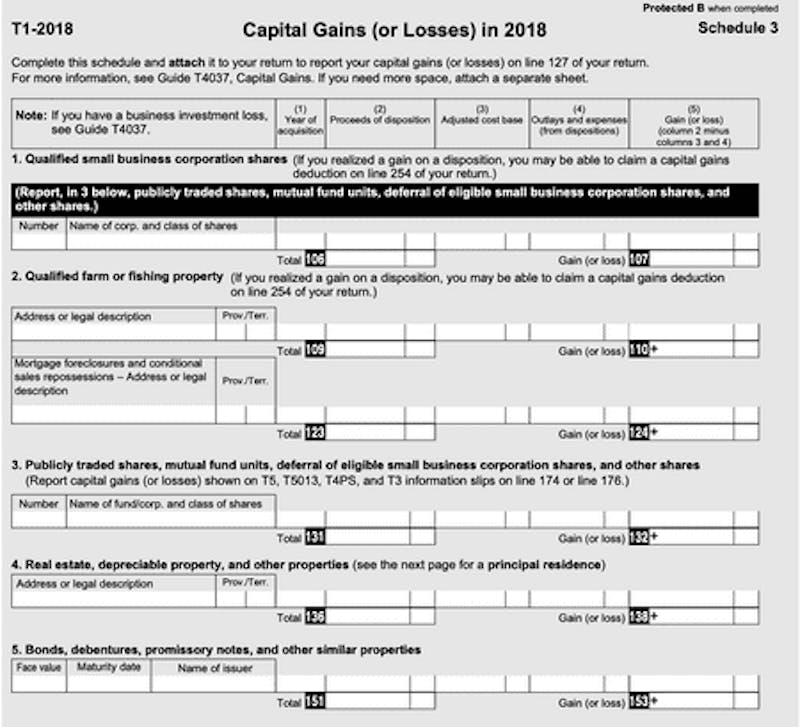

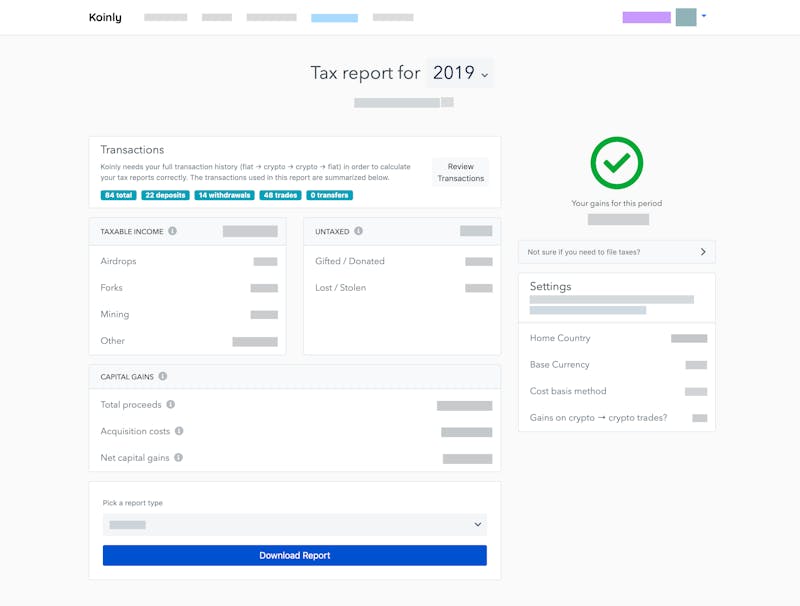

Declare Your Bitcoin Cryptocurrency Taxes In Canada Cra Koinly

As an example if your.

. If you violate the wash sale rule you wont be able to write off the capital loss on that security on your taxes that year. If you suffered losses exceeding 50000 investing in Reconnaissance Energy stock or options between February 28 2019 and September 7 2021 and would like to. Both cash and the value of prizes are considered other income on your Form 1040If you score big you might even receive a Form W-2G reporting your winnings.

A few credits are refundable which means if you owe 250 in taxes but qualify for a 1000 credit youll get a check for the difference of 750. Using losses in the consolidated group. Defer the loss or carry it forward and offset it when you next make a profit company you may be able to carry forward a tax loss for as long as you want and choose the year you want to claim the deduction.

Excluding losses from its ownership stake in Canadian cannabis company Canopy Growth CGC -138 WEED -096 the wine and spirits company earned 252 a share in the latest period. How do tax deductions work. This still may not prevent you from taking those losses in some form in the long term but there is also a risk of loss if the stock price runs back up before you buy it back.

Most tax credits however arent refundable. If youve sold cryptocurrency at a loss you should report them on your taxes as these losses can reduce your net capital gain for the year and your overall tax liability. With Section 1256 investments IRS requires you to report actual or would-be gains and losses through the end of the year on Form 6781.

Subdivision 707-C of the ITAA 1997. Before claiming a group loss or a transferred loss the head company is required to apply the general loss recoupment provisions. Its important to remember that capital losses can not be used to reduce income tax.

Offset your business losses against other types of assessable income for the same income year. 600 or more on a horse race if the win pays at least 300 times the wager amount. Gains and losses on Section 1256 investments and straddles.

Under normal circumstances if you buy a stock at 100 per share and hold it for 10 years you dont have to report any gains or losses until you sell it. The tax code requires institutions that offer gambling to issue Forms W-2G if you win.

Cryptocurrency Pedram Nasseh Cpa Chartered Professional Accountant

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Crypto Currencies Reporting And Taxation Maroof Hs Cpa Professional Corporation Toronto

Bitcoin Taxes How Is Cryptocurrency Taxed In 2021 Picnic S Blog

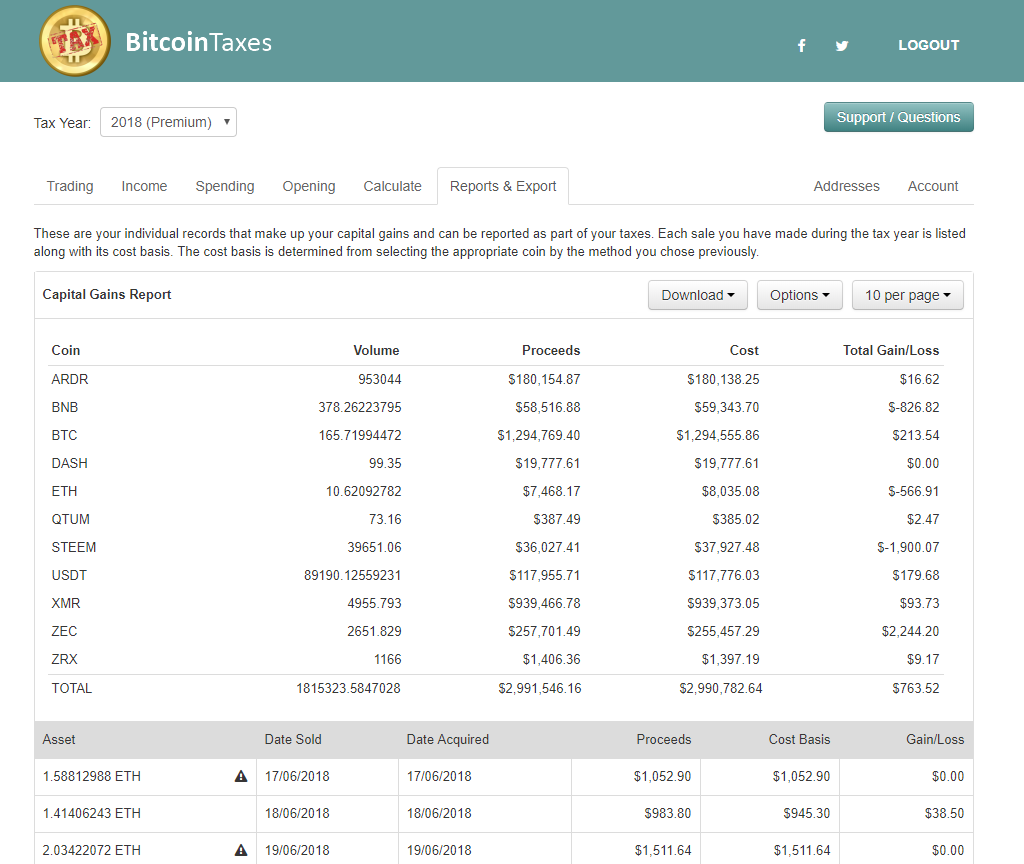

Best Crypto Tax Software Reviews 2021 Tax Season Picnic S Blog

Crypto Bitcoin Business Tax Guide Tax Lawyers In Canada

Cryptocurrency Bitcoin Tax Guide 2021 Edition Cointracker

Tax Loophole Wash Sale Rules Don T Apply To Bitcoin Ethereum Dogecoin

.jpg)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax

Declare Your Bitcoin Cryptocurrency Taxes In Canada Cra Koinly

Your Crypto Tax Questions Answered Lexology

How Is Cryptocurrency Taxed Forbes Advisor

.png)

Reporting Stolen Or Lost Cryptocurrency For Tax Purposes Cryptotrader Tax

What Are 2021 Cryptocurrency Taxes Forbes Advisor

How To Report High Volume Crypto Trades On Taxes Guide

Bitcoin Crash Opens Door To A Tax Loophole For Investors

.png)

The Investor S Guide To Canada Cryptocurrency Taxes Cryptotrader Tax